fsa vs hsa

HSAs are tax-advantaged accounts either you or an employer can open and contribute. 4 For an FSA the 2022 annual contribution limit is 2750 unchanged.

|

| Hsa Vs Fsa Vs Wsa Which Is Best For Your Employees Collage Magazine |

Your choice of healthcare plan will.

. It allows an employee to set aside a portion of their salary to pay for qualified expenses such as medical or dependent care. Two types of accounts can save you money on those out-of-pocket costs such as deductibles and co-payments. HSAs and FSAs both let you save pre-tax money to pay for qualified health care costs. Only people with high-deductible health plans a plan with a deductible of at least.

Depending on your employee demographics and healthcare utilization one type of reimbursement account may work better for your business. Whats the difference between a flexible spending account and a health savings account. HSAs will cover basically all the types of expenses that an FSA will but it also tends to cover more things as well. FSA Pros of HSAs Health savings accounts offer many positives.

But while an HSA and FSA sound similar there are important differences between them. Your HSA will follow you when you change employers or retire. Some of the extra things it covers are. If you use HSA funds to pay for qualified health expenses the money will never be subject to income.

For 2022 the annual contribution limit for an HSA is 3650 for individuals and 7300 for families. Unlike an HSA only employees can open FSAs. In addition an HSA is to be used for longer-term IRS-qualified medical expenses. An eligible high-deductible health plan HDHP is required to open and contribute to an.

HSAs may offer higher contribution limits and allow you to carry funds forward but youre only eligible if youre. -Medicare premiums -Long term care. FSA plans A flexible spending account is a tax-free fund that employees can use to pay for out-of-pocket health care costs. Anybody can contribute to their HSA account.

The difference is that the money paid into the HSA is earmarked for the purpose of paying health care expenses. However the IRS sets a 3600 limit for individuals and a 7200 limit for families. FSAs and HSAs are pre-tax accounts you can use to pay for healthcare related expenses. Even if you become unemployed you can contribute as long as you have an HDHP.

Saving money in an FSA is a great idea if you know youll need it by the end of the plan year. A Health Savings Account HSA or a Flexible Spending. With an HSA you are its owner not your employer or any other. An HSA is a pretax savings account in which the balance rolls over from one year to the next.

The most significant difference between flexible spending accounts FSA and health savings accounts HSA is that an individual controls an HSA and allows contributions. Those 55 and older may also contribute an additional 1000. FSA stands for Flexible Spending Account. HSAs and FSAs both help you save for qualified medical expenses.

|

| Open Enrollment Hsa Vs Fsa Vanderbilt University |

|

| Hsa Vs Fsa Diagnosing The Differences Ascensus |

|

| Hsa Vs Fsa What S The Difference All About Vision |

|

| Hsa Vs Fsa What S The Difference |

|

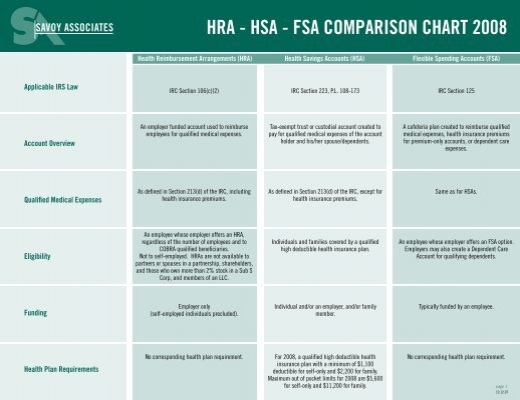

| Hra Hsa Fsa Comparison Chart 2008 Einsurancepeople |

Posting Komentar untuk "fsa vs hsa"